Estonia

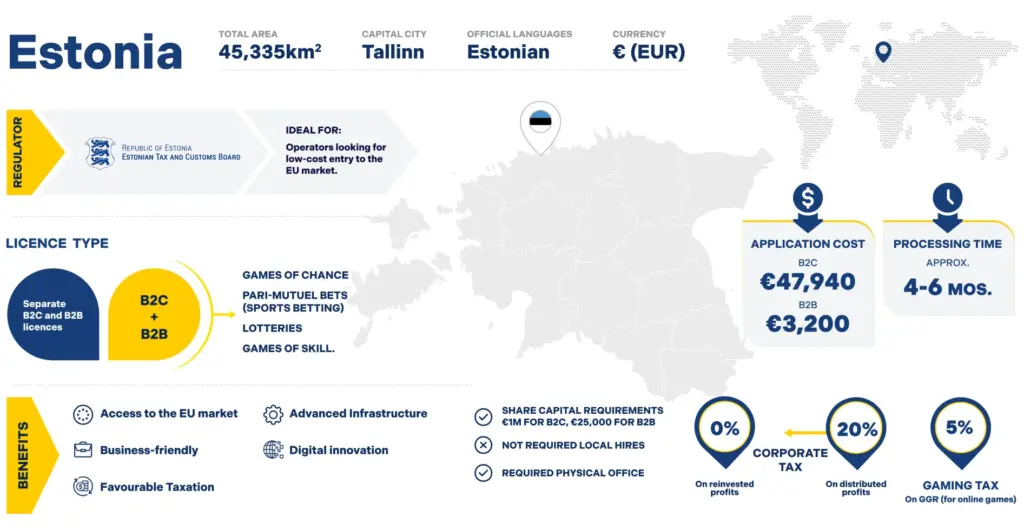

The Estonian Tax and Customs Board oversees licensing and compliance, ensuring that operators adhere to stringent EU standards and maintain transparency in their operations.

Estonia has earned a reputation as a business-friendly jurisdiction, offering a stable regulatory framework and fostering trust among players and operators.

Estonia is an ideal destination for operators seeking low taxes and seamless access to the European Union market. Its streamlined licensing process allows for efficient entry into the iGaming industry, while its advanced digital infrastructure and tech-savvy workforce provide strong support for business growth.

Whether you’re a startup aiming to establish a foothold or an established company looking to expand, Estonia offers a competitive and innovative environment that caters to both operational efficiency and long-term success.

Key Contacts

Downloads

Useful Links

Key Information

Benefits

ESTONIA OFFERS A BUSINESS-FRIENDLY ENVIRONMENT WITH LOW TAXES, A STREAMLINED LICENSING PROCESS AND STRONG DIGITAL INFRASTRUCTURE, MAKING IT A PRIME CHOICE FOR IGAMING OPERATORS.

Favourable taxation

Estonia offers a low tax rate of 5% on gross gaming revenue, making it a cost-effective jurisdiction for operators.

Reputable EU Jurisdiction

Estonia’s regulatory framework aligns with EU standards, providing operators with credibility and legal protections.

Streamlined Licensing Process

Estonia offers a straightforward licensing process with minimal bureaucracy, allowing operators to enter the market quickly.

Digital Infrastructure

Estonia is known for its advanced digital infrastructure, making it an attractive location for tech-savvy iGaming companies.

Skilled Workforce

Estonia has a highly skilled and tech-focused workforce, with expertise in software development, IT, and gaming.

Requirements

THE ESTONIAN TAX AND CUSTOMS BOARD ENFORCES STRINGENT REQUIREMENTS TO ENSURE OPERATOR COMPLIANCE, FINANCIAL INTEGRITY AND PLAYER PROTECTION.

01

Legal Entity

Operators must establish a legal entity in Estonia or the EEA, with a local presence in Estonia required.

02

Player Protection

Operators must implement responsible gaming tools and ensure player funds are protected through segregated accounts.

03

AML & KYC Compliance

Operators must comply with EU anti-money laundering regulations and establish robust KYC procedures.

04

System Audit

No mandatory system audits for iGaming software, but audits are required for financial compliance and data processing.

05

Reporting Obligations

Frequently Asked Questions

What is the application timeframe for an Estonian Gaming License?

The process for obtaining a gaming licence in Estonia takes about 4-6 months, depending on the completeness of the documentation and compliance checks.

What is the licence term?

Estonian gaming licences are valid for 5 years, subject to compliance with local regulations and the payment of annual fees.

Can gambling companies in Estonia be owned by non-residents?

Yes, non-residents are allowed to fully own gambling companies in Estonia.

Are there any residency requirements for company Directors?

No, Estonia does not require directors to be residents, although a local representative for regulatory compliance is mandatory.

What are the authorised capital requirements?

Estonia requires a minimum share capital of €1 million for B2C operators, and €25,000 for B2B suppliers.

What taxes must a licensee pay?

Licensees must pay 5% gaming tax on GGR, along with a 0% tax on reinvested profits and 20% on distributed profits.

Which countries are restricted to licensees?

Estonian-licensed operators can target jurisdictions where online gambling is legal, but must comply with local laws. They cannot operate in blacklisted countries.

What are the essential components of a licensee operation?

Essential components include robust systems for Random Number Generators, financial databases, and player management tools.

Where can I find the regulatory framework?

Estonian gaming regulations are published by the Estonian Tax and Customs Board and are available on their website.

Need assistance?

Whether you have queries, need further assistance or would like to request a quote for any of our services, please don’t hesitate to contact us.

Leave your phone number and we’ll make sure to call you back.