Ireland

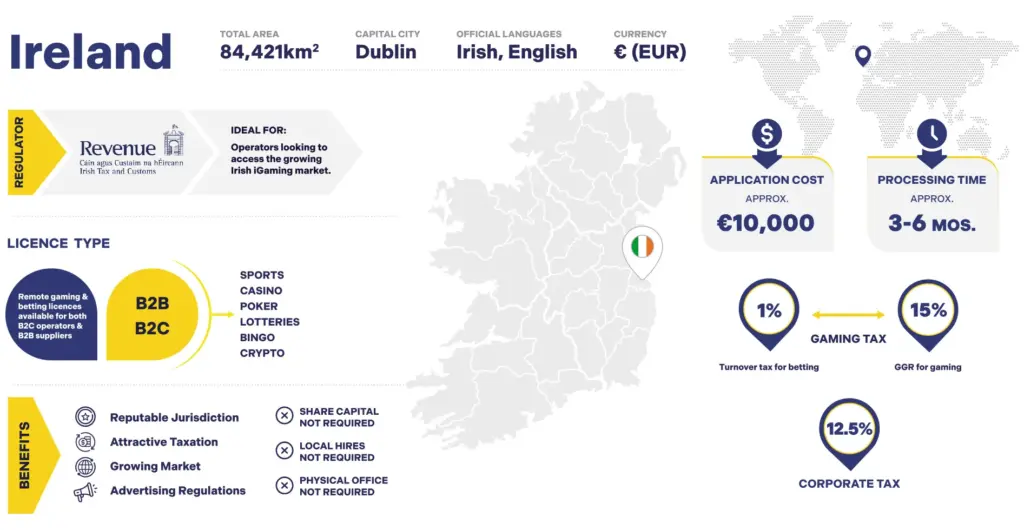

KNOWN FOR ITS BUSINESS-FRIENDLY TAX REGIME AND BEING A GLOBAL HUB FOR TECHNOLOGY AND INNOVATION, IRELAND IS A MEMBER OF THE EUROPEAN UNION AND OFFERS A GROWING IGAMING MARKET.

Ireland’s favourable tax conditions, stable economy and access to the EU single market make it an attractive jurisdiction for both established and aspiring iGaming operators. Its business-friendly environment, coupled with a strong focus on regulatory compliance, provides the ideal foundation for sustainable growth and long-term success.

Discover why Ireland is a top choice for iGaming companies looking to expand their presence in Europe and establish operations in a dynamic and growing market.

Whether you are an experienced operator or a start-up, Ireland offers a balanced environment that supports growth at every stage. With relatively low taxes, streamlined licensing processes, and strong regulatory oversight, it is an ideal jurisdiction for building a reputable and profitable iGaming business.

Key Contacts

Downloads

Useful Links

Key Information

Benefits

OPERATING UNDER THE SUPERVISION OF THE IRISH REVENUE COMMISSIONERS (AND THE UPCOMING GAMBLING REGULATORY AUTHORITY) PROVIDES ACCESS TO A REPUTABLE GROWING MARKET WITH FAVOURABLE TAX CONDITIONS.

Attractive taxation

Ireland offers a low gambling tax of 1% on turnover for betting operators and 15% on net revenue for online gaming operators, making it a competitive environment for operators.

Reputable Jurisdiction

An Irish licence enhances an operator’s credibility thanks to a strong regulatory framework and commitment to responsible gaming.

Growing Market

Ireland’s vibrant economy and rising demand for online gaming services make it an attractive market for iGaming operators.

Advertising Regulations

Ireland enforces strict advertising rules around gambling content. These include prohibiting the targeting of minors or vulnerable people and enforcing limits on when and where gambling advertising can appear.

Requirements

01

Legal Entity

02

Capital Requirements

No specific capital requirement is imposed, but financial stability must be demonstrated through detailed business plans and financial records.

03

Financial Viability

Operators must submit financial documents proving that they have the financial resources to run a sustainable and compliant iGaming business.

04

Responsible Gaming

05

Technical Compliance

All gaming systems must undergo testing by accredited third-party auditors to ensure they meet Irish standards for fairness and transparency.

06

AML & KYC Procedures

07

System Audit

08

Reporting Obligations

Operators must submit annual financial reports and gaming activity summaries to the Irish Revenue Commissioners.

09

Compliance Audits

Regular audits are required to ensure that operators remain compliant with Irish gambling laws.

10

Advertising Regulations

Ireland imposes strict rules on gambling advertising. Operators must ensure that ads do not target minors, mislead consumers, or promote excessive gambling behaviours. Breaches of advertising rules can lead to significant fines.

11

Links & Signage

Operators must display licence information and provide links to responsible gambling resources. The Gambling Regulatory Authority is expected to introduce stricter signage rules.

Frequently Asked Questions

What is the application timeframe for an Irish Remote Gaming License?

The application process typically takes 3-6 months, depending on the completeness of the documents provided and how quickly the Revenue Commissioners can process the application.

What is the licence term?

Irish gambling licences are valid for 2 years and must be renewed upon expiry, provided the operator complies with all relevant regulations.

Can gambling companies in Ireland be owned by non-residents?

Yes, non-residents are allowed to own gambling companies in Ireland. There are no restrictions on foreign ownership.

Are there any residency requirements for company Directors?

There are no residency requirements for directors, but the company must have a registered office in Ireland.

What are the authorised capital requirements?

Ireland does not impose specific capital requirements for gambling companies, but the applicant must demonstrate financial viability.

What taxes must a licensee pay?

Operators must pay a 1% tax on turnover for betting services and a 15% gaming tax on GGR for gaming services. Corporate tax is set at 12.5%.

Which countries are restricted to licensees?

Irish licensees can operate globally, but they must ensure compliance with local laws in any country they target.

What are the essential components of a licensee operation?

Essential components include secure player databases, game servers, Random Number Generators, and financial management systems to comply with Irish regulations.

Where can I find the regulatory framework?

Need assistance?

Whether you have queries, need further assistance or would like to request a quote for any of our services, please don’t hesitate to contact us.

Leave your phone number and we’ll make sure to call you back.