Isle of Man

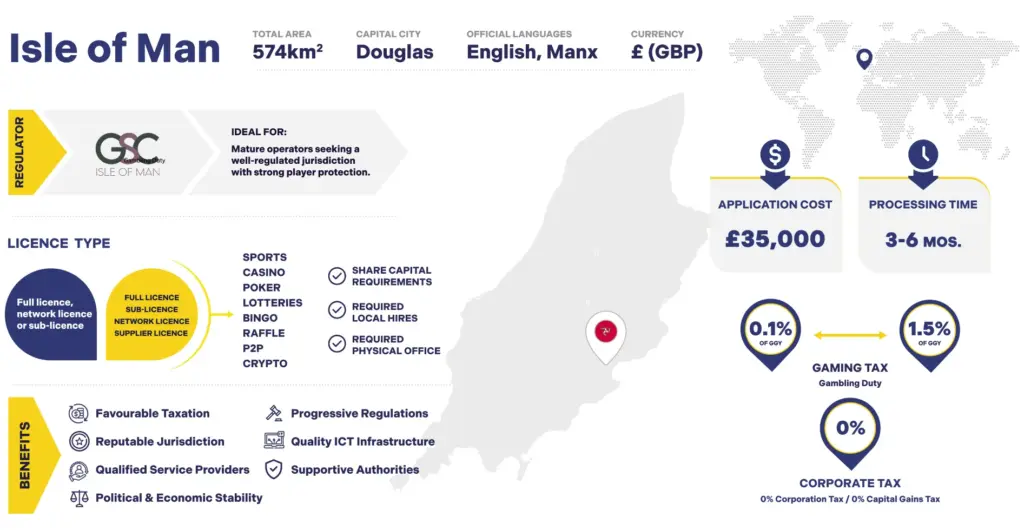

THE ISLE OF MAN IS A WELL-RESPECTED JURISDICTION FOR IGAMING, KNOWN FOR ITS STRONG REGULATORY OVERSIGHT, HIGH LEVEL OF PLAYER PROTECTION, AND ZERO PERCENT GAMING TAX. THE ISLE OF MAN GAMBLING SUPERVISION COMMISSION (GSC) ENSURES THE INTEGRITY OF THE MARKET.

The Isle of Man is a premium jurisdiction for operators seeking a highly reputable iGaming license. Known for its robust regulatory framework and commitment to full player protection, the Isle of Man provides a stable and reliable environment for online gaming businesses.

Its licensing process is designed to foster trust and credibility, offering operators the assurance of compliance with the highest international standards.In addition to its strong regulatory reputation, the Isle of Man offers significant tax advantages, including a 0% corporate tax rate for most gaming companies. Its strategic location provides direct access to the UK and global markets, making it an attractive base for businesses aiming to expand internationally.

With world-class digital infrastructure, a highly skilled workforce and a business-friendly government, the Isle of Man stands out as a leading destination for both established operators and startups in the iGaming industry.

Key Contacts

Downloads

Useful Links

Key Information

Benefits

THE ISLE OF MAN OFFERS A WORLD-CLASS REGULATORY ENVIRONMENT, COMBINING CREDIBILITY, TAX ADVANTAGES AND GLOBAL MARKET ACCESS.

Reputable Jurisdiction

The Isle of Man’s GSC is known for its strict regulatory framework and commitment to fairness, providing operators with credibility.

Zero Gaming Tax

The Isle of Man offers 0% gaming tax, along with an attractive 10% corporate tax rate, significantly reducing operational costs.

Player Protection

Operators must segregate player funds, ensuring player protection in the case of insolvency. This builds trust with players and stakeholders.

Global Market Reach

The Isle of Man licence is recognised globally, allowing operators to access international markets, particularly the UK and Europe.

Blockchain and Crypto-Friendly

The Isle of Man supports the use of blockchain and cryptocurrencies, making it an attractive option for operators interested in innovative financial technologies.

Requirements

THE ISLE OF MAN GAMBLING SUPERVISION COMMISSION (GSC) IMPOSES STRICT REQUIREMENTS TO ENSURE FINANCIAL INTEGRITY PLAYER PROTECTION AND TECHNICAL COMPLIANCE.

OPERATORS MUST MEET RIGOROUS STANDARDS IN LEGAL STRUCTURE FINANCIAL STABILITY AND SYSTEM SECURITY TO OPERATE WITHIN THIS HIGHLY REPUTABLE JURISDICTION.

01

Legal Entity

Operators must incorporate a local company with a registered office in the Isle of Man. This company must have at least two local directors.

02

Financial Stability

03

Player Fund Protection

04

System Audit

Mandatory annual financial audits and technical system audits (game fairness and RNG) as part of the licensing process.

05

Reporting Obligations

Operators must submit regular reports to the GSC, including financial reports, gaming activity summaries, and compliance updates.

06

Compliance with AML & KYC

Strict AML and KYC requirements must be met, including the appointment of a Money Laundering Reporting Officer (MLRO).

Frequently Asked Questions

What is the application timeframe for a Gaming License?

The Isle of Man licence application typically takes 3-6 months, depending on how quickly the applicant provides the necessary documents.

What is the licence term?

The licence is valid indefinitely, provided the operator complies with the Gambling Supervision Commission’s regulations and pays the required annual fees.

Can gambling companies in the Isle of Man be owned by non-residents?

Yes, non-residents are allowed to own gambling companies in the Isle of Man without restrictions on foreign ownership.

Are there any residency requirements for company Directors?

Yes, at least one director must be a resident of the Isle of Man to ensure local compliance with the Gambling Supervision Commission.

What are the authorised capital requirements?

The minimum share capital for an Isle of Man licence is £35,000.

What taxes must a licensee pay?

Gaming operators in the Isle of Man benefit from a 0% corporate tax rate, but must pay a gaming tax that starts at 1.5% on GGR and decreases as revenue increases.

Which countries are restricted to licensees?

Licensees may operate in most jurisdictions globally, provided they comply with local laws.

What are the essential components of a licensee operation?

The Isle of Man requires operators to maintain robust systems for player management, gaming software, and financial data.

Where can I find the regulatory framework?

The Isle of Man’s regulatory framework can be found on the Gambling Supervision Commission website, including details on licensing and compliance.

Need assistance?

Whether you have queries, need further assistance or would like to request a quote for any of our services, please don’t hesitate to contact us.

Leave your phone number and we’ll make sure to call you back.