Canada

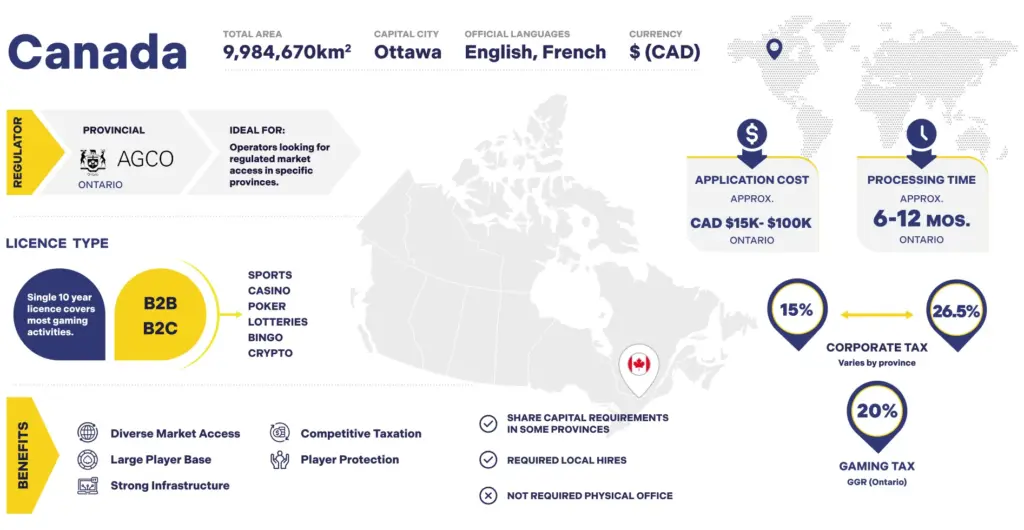

CANADA, KNOWN FOR ITS STRONG ECONOMY, PROGRESSIVE LEGAL FRAMEWORK AND HIGH STANDARD OF LIVING, HAS BECOME A POPULAR LOCATION FOR BOTH OPERATORS AND B2B SERVICE PROVIDERS IN THE IGAMING INDUSTRY.

Stretching from the Pacific to the Atlantic, Canada is a diverse and prosperous nation with a well-developed digital economy. Its provincial licensing model allows each region to craft its own iGaming regulations, offering operators tailored opportunities to access Canada’s expansive and lucrative market.

With regions like Ontario setting the benchmark for a modernised and competitive iGaming landscape, Canada provides a strong digital infrastructure, a tech-savvy population and competitive taxation rates, making it an attractive jurisdiction for online gaming operators and positioning the country as an emerging global leader in the online gambling industry.

In addition to its favorable business environment, Canada’s focus on responsible gambling and stringent regulatory oversight ensures player protection and fosters trust within the industry. This balanced approach allows operators to grow sustainably while maintaining compliance with high industry standards.

Key Contacts

Downloads

Useful Links

Key Information

Benefits

Diverse Market Access

Canada’s provincial regulation model offers flexibility for operators to enter multiple markets, with regions like Ontario leading the way in online gambling.

Large Player Base

With over 30 million internet users, Canada offers a large, engaged, and tech-savvy audience for iGaming services and platforms.

Strong Infrastructure

Canada benefits from high-quality digital infrastructure and skilled tech talent, making it a prime location for both operators and B2B platform providers.

Competitive Taxation

Canada offers competitive tax rates compared to other major jurisdictions, with operators taxed primarily on a provincial basis.

Player Protection

Canadian iGaming regulations prioritise responsible gambling and player protection, ensuring fair gaming practices and compliance with strict AML/KYC regulations.

Requirements

01

Legal Entity

Operators must establish a legal entity in Canada or within the province they wish to operate in.

02

Capital Requirements

No specific minimum capital requirement exists, but operators must demonstrate financial stability and capacity through business plans and financial reports.

03

Financial Viability

Operators must provide proof of financial solvency and the ability to meet all operational costs and player obligations.

04

Responsible Gaming

Operators and B2B providers must comply with provincial requirements for responsible gaming, including offering tools for self-exclusion and deposit limits.

05

Technical Infrastructure

All gaming systems must undergo independent testing and certification to ensure fairness, security, and compliance with provincial technical standards.

06

AML/KYC Compliance

Operators must adhere to provincial and national anti-money laundering laws and implement strong KYC procedures.

07

Advertising Regulations

Canada’s advertising laws for iGaming are governed at the provincial level, but operators are expected to ensure that ads do not target minors or promote irresponsible gambling. Violations of advertising laws may result in fines.

08

System Audit

Operators must undergo regular system audits to ensure ongoing compliance with provincial requirements.

09

Reporting Obligations

Operators are required to submit regular financial reports, including player activity summaries and AML compliance reports, to provincial authorities.

10

Compliance Audits

Provincial authorities conduct regular compliance audits to ensure operators remain in line with regulations.

11

Links and Signage

Operators must clearly display their licence details on their websites and provide links to responsible gaming resources.

Frequently Asked Questions

What is the application timeframe for an Ontario iGaming License?

The application process for an Ontario iGaming licence takes approximately 6-12 months, depending on the completeness of the application and how quickly the Alcohol and Gaming Commission of Ontario (AGCO) receives the necessary documentation.

What is the licence term?

Ontario licences are valid for 5 years, provided operators comply with AGCO regulations and pay the required annual fees.

Can gambling companies in Ontario be owned by non-residents?

Yes, non-residents can own gambling companies in Ontario. However, they must comply with all local regulations, and key individuals must undergo “fit and proper” checks by the AGCO.

Are there any residency requirements for company Directors?

Directors do not need to be Ontario residents, but the company must appoint a local representative responsible for regulatory compliance.

What are the authorised capital requirements?

There are no specific capital requirements, but applicants must demonstrate financial stability to operate within the Ontario market.

What taxes must a licensee pay?

Operators in Ontario must pay 20% of their gross gaming revenue to the provincial government, in addition to standard corporate tax rates, which vary between 11.5% and 26.5%.

Which countries are restricted to licensees?

Ontario-licensed operators must comply with local laws in each jurisdiction they wish to target. They cannot operate in jurisdictions where online gambling is prohibited or regulated under a different local licensing regime.

What are the essential components of a licensee operation?

Operators must have secure systems for Random Number Generators, player data, financial management, and responsible gaming measures.

Where can I find the regulatory framework?

The regulatory framework is provided by the Alcohol and Gaming Commission of Ontario (AGCO) and iGaming Ontario (iGO) and is available on their official websites.

Can I operate in other Canadian provinces with an Ontario license?

Each province in Canada has its own regulatory framework for iGaming. In British Columbia, Quebec, Alberta, and Atlantic Canada, iGaming is managed by government-controlled platforms, such as PlayNow.com and Espacejeux. Private operators cannot apply for licences in these provinces, as they do not allow private companies to run iGaming services. Ontario is the only province that has opened its market to private operators. However, if other provinces change their regulations in the future, Ontario-licensed operators may need to comply with new local rules to operate there.

Need assistance?

Whether you have queries, need further assistance or would like to request a quote for any of our services, please don’t hesitate to contact us.

Leave your phone number and we’ll make sure to call you back.